Bitcoin-based (BTC) non-fungible token (NFT) protocol Ordinals has minted over 100,000 NFTs despite only launching on Jan. 21, 2023 — but some believe it should have never launched.

According to Dune analytics data, nearly 107,000 ordinals have already launched, showing significant interest in the project, but many believe the project wastes bitcoin’s precious blockchain space to save what they view as nothing more than useless data.

This is because Ordinal NFTs — called “Inscriptions” — are stored entirely on-chain, including the content that the tokens are representing, resulting in media stored directly on the blockchain.

This means that Inscriptions result in data such as images, short videos and PDF versions of the bitcoin whitepaper being stored directly on-chain. This is all data that all the network’s full nodes will have to download to be able to operate, significantly increasing the storage requirements of the devices that the node software runs on.

Traditionally, non-financial data on bitcoin’s blockchain was stored in so-called OP_RETURN entries limited to 80 bytes — enough for eighty ASCII characters, basically a short sentence — after an increase from an earlier limit of 40 bits.

Neither of those limits allowed for images or PDFs, let alone videos, but the recent introduction of the Taproot upgrade activated on Nov. 12, 2021, introduced a workaround for this limitation. Instead of using the OP_RETURN entry,

Inscriptions are stored in Taproot script-path spend scripts entries OP_FALSE, OP_IF, and OP_PUSH.

Taproot was meant to facilitate the development of more advanced smart contracts on the Bitcoin blockchain, but Ordinal developers found it to also offer an easy hack for staring larger than usually permitted quantities of data on the blockchain.

The situation is a good example of why introducing new features and more complexity into blockchain systems meant to be dependable and solid such as bitcoin has been made an excruciating process.

With how the bitcoin blockchain currently operates, there is not limit other than the block size, with Bitcoin core software limiting the size of this data to 400,000 bytes or just 0.4 megabytes — one-tenth of a block. This is because with the introduction of SegWit back in 2017 the transaction size limit was raised to 400,000 weight units, at the current block size equivalent to one byte each.

Consequently, now it is possible to store 5,000 times more data on the Bitcoin blockchain, and there is no way to stop this use of the blockchain without another protocol upgrade. Such transactions can easily eat up block space that could be also needed by financial transactions, also raising transaction prices and slowing their processing times.

SegWit also introduced a 75% fee discount on witness transaction data — the kind of data that NFTs are stored as — meaning that NFT minting is also more cost-effective per byte stored on chain than simple financial transactions.

This also does not play in favor of the Ordinal’s proponents’ claim that this system is subsidizing miners by paying a significant amount of transaction fees.

Dune Analytics data shows that a total of $129,000 of BTC was spent on fees to inscribe Ordinals NFTs. Also, Taproot utilization rate took off significantly, according to another chart.

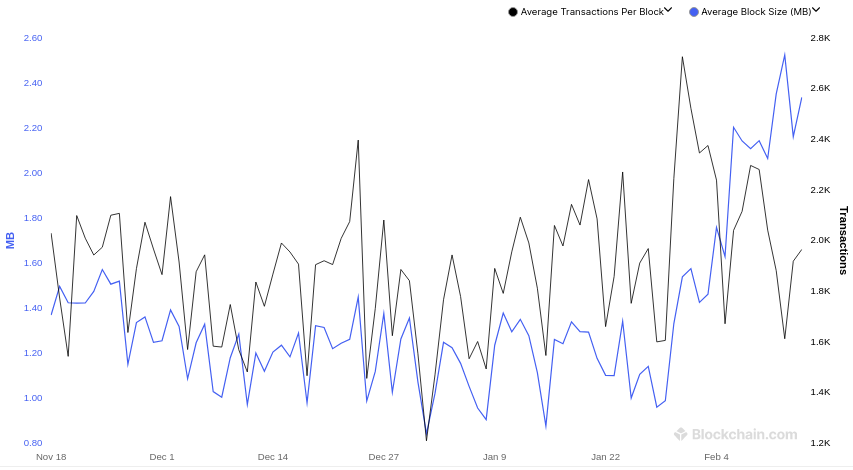

Similarly, Bitcoin’s daily average block size also saw a significant increase, despite the average number of transactions per block not following the same pattern since the introduction of Ordinals.

Ordinals are moved by moving a specific satoshi stored in the wallet of the NFT owner, meaning that further transactions do not enjoy any particular fee discounts and do not put any significant strain on the network. Only minting new NFTs has been viewed as controversial by many network participants.

NFTs are unique digital assets that are stored on a blockchain, a decentralized digital ledger that allows for secure transactions without the need for a centralized authority.

Each NFT is one-of-a-kind and can represent anything from digital artwork to tweets, music, or videos. Unlike cryptocurrencies such as bitcoin or ethereum (ETH), which are fungible and interchangeable with one another, each NFT is distinct and has its own value based on its rarity, authenticity, and demand.

The findings follow recent reports that Reddit’s Collectible Avatars program has given millions of free NFTs to users, including first-timers.

Main content of the article:

Summarize this content to 120 words

Bitcoin-based (BTC) non-fungible token (NFT) protocol Ordinals has minted over 100,000 NFTs despite only launching on Jan. 21, 2023 — but some believe it should have never launched.

According to Dune analytics data, nearly 107,000 ordinals have already launched, showing significant interest in the project, but many believe the project wastes bitcoin’s precious blockchain space to save what they view as nothing more than useless data.

This is because Ordinal NFTs — called “Inscriptions” — are stored entirely on-chain, including the content that the tokens are representing, resulting in media stored directly on the blockchain.

This means that Inscriptions result in data such as images, short videos and PDF versions of the bitcoin whitepaper being stored directly on-chain. This is all data that all the network’s full nodes will have to download to be able to operate, significantly increasing the storage requirements of the devices that the node software runs on.

Traditionally, non-financial data on bitcoin’s blockchain was stored in so-called OP_RETURN entries limited to 80 bytes — enough for eighty ASCII characters, basically a short sentence — after an increase from an earlier limit of 40 bits.

Neither of those limits allowed for images or PDFs, let alone videos, but the recent introduction of the Taproot upgrade activated on Nov. 12, 2021, introduced a workaround for this limitation. Instead of using the OP_RETURN entry,

Inscriptions are stored in Taproot script-path spend scripts entries OP_FALSE, OP_IF, and OP_PUSH.

The entries needed to publish a text-based NFT featuring “Hello, world!” as its content. | Courtesy of the Ordinals documentation

Taproot was meant to facilitate the development of more advanced smart contracts on the Bitcoin blockchain, but Ordinal developers found it to also offer an easy hack for staring larger than usually permitted quantities of data on the blockchain.

The situation is a good example of why introducing new features and more complexity into blockchain systems meant to be dependable and solid such as bitcoin has been made an excruciating process.

With how the bitcoin blockchain currently operates, there is not limit other than the block size, with Bitcoin core software limiting the size of this data to 400,000 bytes or just 0.4 megabytes — one-tenth of a block. This is because with the introduction of SegWit back in 2017 the transaction size limit was raised to 400,000 weight units, at the current block size equivalent to one byte each.

Consequently, now it is possible to store 5,000 times more data on the Bitcoin blockchain, and there is no way to stop this use of the blockchain without another protocol upgrade. Such transactions can easily eat up block space that could be also needed by financial transactions, also raising transaction prices and slowing their processing times.

SegWit also introduced a 75% fee discount on witness transaction data — the kind of data that NFTs are stored as — meaning that NFT minting is also more cost-effective per byte stored on chain than simple financial transactions.

This also does not play in favor of the Ordinal’s proponents’ claim that this system is subsidizing miners by paying a significant amount of transaction fees.

Dune Analytics data shows that a total of $129,000 of BTC was spent on fees to inscribe Ordinals NFTs. Also, Taproot utilization rate took off significantly, according to another chart.

Bitcoin taproot utilization. | Courtesy of Dune Analytics

Similarly, Bitcoin’s daily average block size also saw a significant increase, despite the average number of transactions per block not following the same pattern since the introduction of Ordinals.

Average bitcoin’s transaction size three-month chart. | Courtesy of Blockchain.com

Ordinals are moved by moving a specific satoshi stored in the wallet of the NFT owner, meaning that further transactions do not enjoy any particular fee discounts and do not put any significant strain on the network. Only minting new NFTs has been viewed as controversial by many network participants.

NFTs are unique digital assets that are stored on a blockchain, a decentralized digital ledger that allows for secure transactions without the need for a centralized authority.

Each NFT is one-of-a-kind and can represent anything from digital artwork to tweets, music, or videos. Unlike cryptocurrencies such as bitcoin or ethereum (ETH), which are fungible and interchangeable with one another, each NFT is distinct and has its own value based on its rarity, authenticity, and demand.

The findings follow recent reports that Reddit’s Collectible Avatars program has given millions of free NFTs to users, including first-timers.