The crypto market is witnessing a massive crisis as crypto-friendly banks Silvergate, Silicon Valley Bank, and now Signature Bank faces bank runs. The “bank run” driven by depositors withdrawing money from the bank is causing stablecoins to depeg to the US dollar. Many stablecoins, especially Circle’s USDC, have depegged creating a systemic effect on other stablecoins and cryptocurrencies.

Why Bitcoin Price Soaring Despite Market Crisis

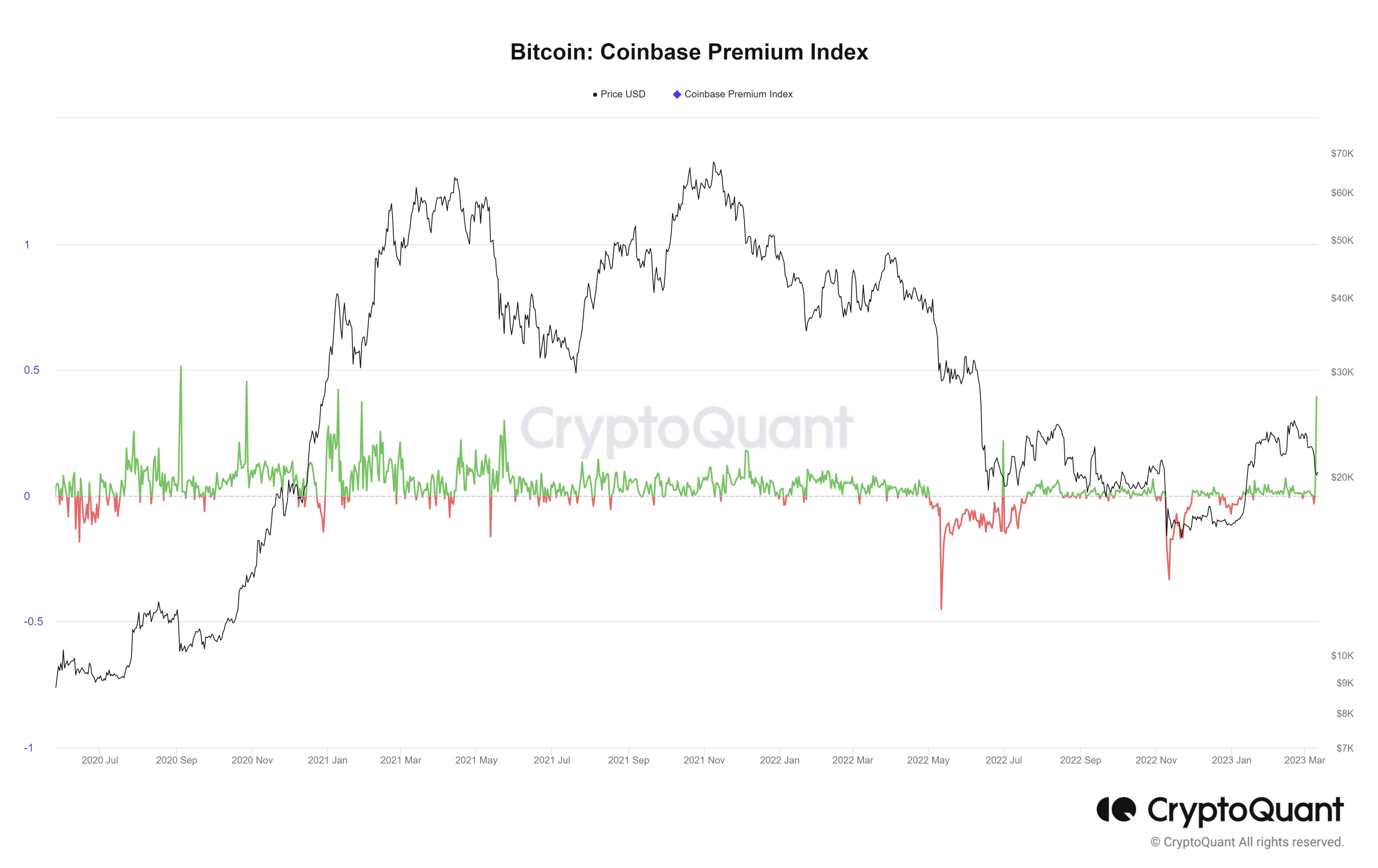

Bitcoin price is trending higher as it trades at a $300 premium on Coinbase right now. Coinbase Premium Index for Bitcoin has hit a 26-month high.

Coinbase Premium is the percentage difference between Coinbase Pro price (USD pair) and Binance price (USDT pair). Typically, higher premium values indicate investors in the U.S. are buying Bitcoin on Coinbase.

However, Circle’s USDC stablecoin massive exposure of $3.3 billion to Silicon Valley Bank and other stablecoins dependence on USDC have led to a massive imbalance in the Bitcoin price.

As investors move away from USDC, BTC premium on Coinbase jumps massively as their order books are merged with USD and USDC. Bitcoin premium means massive negative funding on perpetual. Experts believe that people think it is a short squeeze, but data shows otherwise.

Bitcoin price is currently trading at $20,426, up over 3% in the last 24 hours. The 24-hour low and high for BTC price are $19,628 and $20,792, respectively.

Why Ethereum Price Is Rising?

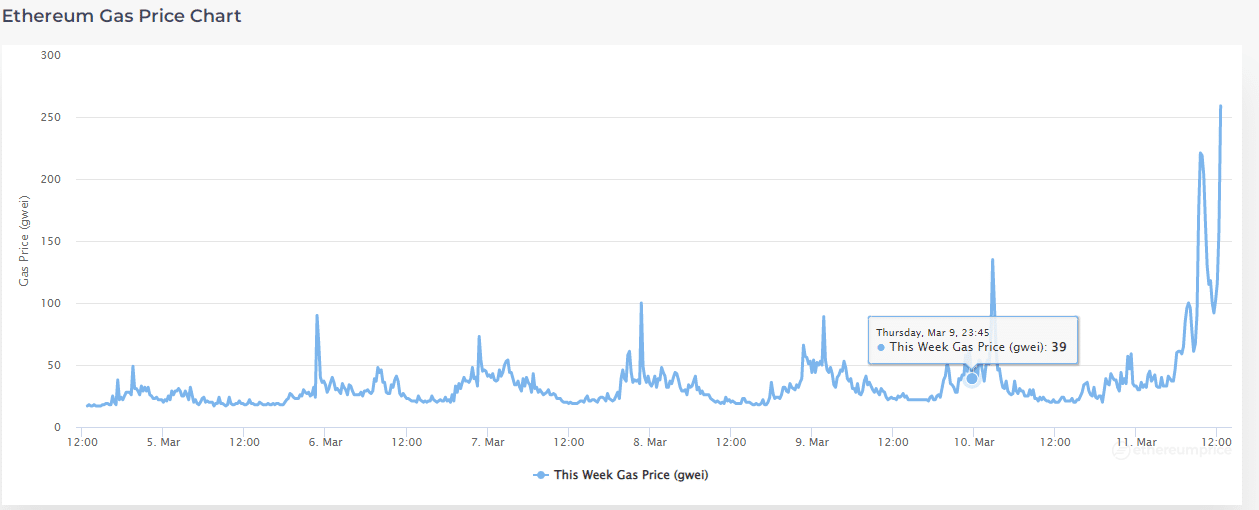

Ethereum price is rising higher as gas fees soared after the crypto market ties to banks continue to fade. As per data by Etherscan, the average gas fees jumped above 300 gwei today against the earlier median gas fees of 32-40 gwei.

Uniswap, USD Coin, and 1inch are the top 3 gas guzzlers for Ethereum, indicating that investors are converting their USDC coins to Ethereum.

Ethereum price currently trades at $1,463, up 5% in the last 24 hours. The 24-hour low and high are $1,378 and $1,481, respectively.

Main content of the article:

Several crypto-friendly banks, including Silvergate, Silicon Valley Bank, and Signature Bank, are facing bank runs as depositors withdraw money from the banks, causing stablecoins to depeg from the US dollar. Circle’s USDC stablecoin has a massive exposure of $3.3 billion to Silicon Valley Bank, leading to an imbalance in the Bitcoin price as investors move away from USDC. This has caused the Bitcoin premium on Coinbase to jump massively as order books are merged with USD and USDC, leading to massive negative funding on perpetual. However, despite the market crisis, Bitcoin and Ethereum prices are trending higher, with Bitcoin currently trading at $20,426, up over 3% in the last 24 hours, and Ethereum trading at $1,463, up 5% in the last 24 hours.